The Banking and Financial Services Sector has been at the forefront of adopting new technology and this has been no different with RPA. Financial Institutions have been one of the earliest adopters of Robotic Process Automation (RPA) across various business lines.

Be it customer service, Know Your Customer (KYC) and Anti Money Laundering (AML) compliance, loans, credit cards, personal banking, mobile banking, corporate banking, private banking, financial planning, wealth management, insurance, and much more, RPA has been successfully deployed in each of these functions across organizations globally.

Automation works great at scale and the Financial Services Sector operates on a massive one … therefore they see significant ROI by using RPA. With rising competition in this space, firms that put RPA to good use can redeploy their human workforce to more creative and innovative projects that can increase revenue, client engagement, and satisfaction.

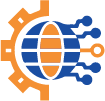

The Banking and Financial Services Sector can also see the following gains from leveraging RPA, ML and AI.

Increase operational efficiencies

AI technologies including the use of bots dramatically increase outputs, reduce errors and streamline outcomes; and provide cost savings.

Enhance the customer journey

Accelerate access to customer data, gathering data at speed in real-time, and resolving request resolutions faster.

Reshape the employee experience

Refocus employees on high-value tasks, allowing robots and automation to handle data collection, discover patterns, sort through data, analyze risk, populate the CRM, ERP and much more.

Minimize compliance risk

Improve KYC and AML reporting with automated systems monitoring databases, watchlists and other external sources. Leverage AI and machine learning to find gaps, match relationships, and discover unidentified risks.